Managing Your Money

Please note that the following are my personal opinions and in no way constitute professional or legal advice. Please note that this is written from an Australian context meaning that some of the recommended options may not apply to someone outside of Australia.

This is the one in a series of posts exploring how you can go about managing your finances and getting out of debt.

If you’re struggling with debts, the worst thing you can do is ignore the problem and hope it will go away. You may be embarrassed, fearful, or even too proud to ask for help and advice. Don’t let your emotions stop you from tackling your debt. Working to bring your debts back under control will be difficult and demanding but it is possible to get back in control. If you require professional help I would recommend CAP. They currently operate in the UK, Australia, New Zealand, Canada, and the USA.

The equation is simple, spend less than you earn. Your options are:

- Earn more,

- Spend less, or

- A combination of both

There are 3 principles using the CAP philosophy that I propose for allowing you to manage your money.

- The first and most important is that you need to complete a budget. It is important to start knowing what you are spending (and earning).

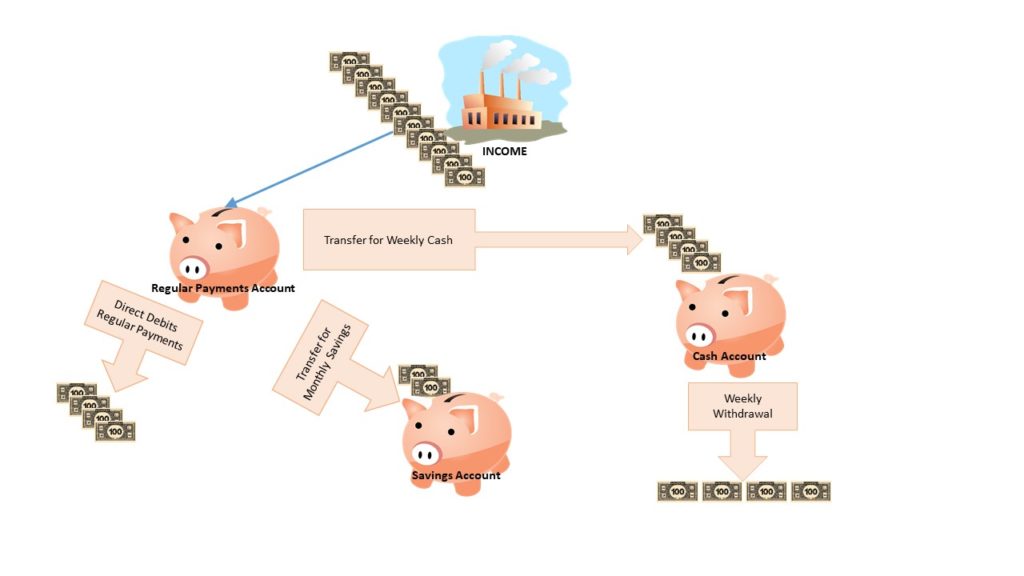

- The second is using 3 accounts to manage your money. Use a ‘regular payments account’ for all Direct Debits and Periodic Payments, a ‘cash account’ for other expenses and a ‘savings account’ for anything you’re saving for.

- The third is using cash instead of credit cards. Using cash is counter-cultural, but has many advantages. By using cash, you will find it brings the value back of money. Once you are back in control of your money you could consider using a debit card.

Budget

The first step is to complete a budget – get it all down on paper so to speak. I suggest you use your bank statements for the past year to ensure that you capture all your expenses.

You can use either the ASIC Budget Planner or the following Budget Worksheet .

The Budget Worksheet provides columns for:

- a ‘regular payments account’ for all Direct Debits and Periodic Payments,

- a ‘cash account’ for other expenses and,

- a ‘savings account’ for anything you’re saving for.

If your budget doesn’t balance, don’t panic! Any problems you can see were already there; you have just uncovered them and can now start to work on the solution.

Spend Less

Spending less involves either, doing it cheaper, doing it less or don’t do it.

You may be spending money on things that perhaps you don’t need, or are not getting much benefit from. You might be able to cut down on your food bill, changing to cheaper supermarkets, no longer getting any takeaways, taking lunch to work. You might be able to cancel subscription TV/movie services, change your phone plan, or renegotiate insurance. You might consider not going away on holiday until you have built up some savings.

You could also look to renegotiate repayments on loans and credit cards under hardship provisions. In many cases it is possible to negotiate to only pay back the principal.

Earn More

A few options to consider to increase your income are, working additional hours, taking on a second job e.g. dog walker, taking in a boarder, or selling items you don’t need. Maybe you can rent out your car or your garage. Finally consult www.australia.gov.au to see if there benefits you are not claiming.

By spending less (and yes it is possible) and maybe earning a little more it is possible to balance your budget and reduce your debts.

It Does Not Balance

If your budget still doesn’t balance, you may need to go back through these steps again and be a little more ruthless. If you have done all you can with your budget and still have more going out than you have coming in, you may have unmanageable debt and need professional support.

Don’t worry – you have just unearthed a problem that was already there. Now you can deal with it.

Using 3 Accounts

Once you have your budget, you need a system to help you control your spending. The system of using 3 accounts proposed by CAP is a great way to help you manage your spending.

Using this system will help you to prioritise your expenditure and make sure that your money goes on the things you have planned for.

The way it works is, your income goes into the regular payments account and your direct debits and periodic payments go out of it. Then, a monthly amount is transferred into your savings account and enough to cover all your weekly cash expenses is transferred into your cash account.

At the time of writing, NAB and Suncorp were providing fee free bank accounts with no special conditions. You can use https://www.finder.com.au/bank-accounts/fee-free to check which banks current offer fee free accounts.

Regular Payments Account

It is probably best to use your existing current account as your regular payments account. It is likely that your income will already go into this account and most of your regular payments will come out of it. These include for example, rent, household bills or your mobile phone contract.

Savings Account

Use the savings account to hold your long and short-term savings. It’s helpful to use an account that is easy to access so that you can move your money easily when you need to. Remember, you need to setup a regular transfer from your Regular Payments Account to your Savings Account.

Your savings account is used to hold:

- Short-term savings: Things that can be saved for within the year. e.g. car registration, furniture or birthday presents.

- Long-term savings: Things that take longer than a year to save for. e.g. a car, home renovations or a holiday.

It is a good idea to save some money for those unexpected expenses that so often start the spiral into debt, e.g. washing machine breaks down.

Cash Account

You will need to withdraw cash on a weekly basis to pay for things such as food, transport and any other weekly expenses. When choosing a cash account, it’s helpful to choose an everyday account with a debit card so that you can access your money easily.

Using Cash

Why use cash? Nobody uses cash anymore! That may be true but, cash re-values money and re-values purchases.

Using cash is counter-cultural, but has many advantages. By using it on a weekly basis you will find it brings the value back to money. Handing over cash at the till and getting less money back in change will feel very different to handing over a card and getting back the exact same thing. You will also know exactly where you’re at with your money at all times. It will help you to live within your means, preventing you from buying things you can’t afford. If you don’t have the money, you can’t buy it!

Draw enough money weekly for that week’s expenses. Now that you have a budget, you know how much you need.

Separating your cash into separate envelopes may help you divide up the money within the week’s budget, e.g. fuel, food, eating out. It is safer and will help you not to spend it all at once!

If you are tempted to make a spontaneous purchase using cash, think through the following: Do I need it? Can I afford it? Will I use it? Is it worth it?

Your Path to Financial Freedom

Your Path to Financial Freedom  Debt Reduction – Your Options

Debt Reduction – Your Options